Mortgage Blog

Start Your New Life In Your New Home

The 2024 Canadian Housing Market: A Tale of Interest Rates, Immigration, and Consumer Spending

August 14, 2024 | Posted by: Dallas Martin

Welcome to the wild world of the 2024 Canadian housing market, where the rules are made up, and the interest rates actually matter. Buckle up as we dive deep into the latest numbers, experts' opinions, and the economic ups and downs keeping homebuyers, renters, and developers on their toes. Let's explore how immigration, consumer spending, and the ever-fluctuating interest rates are shaping the landscape.

Immigration: The Welcome Mat is Out (But the Homes Are Few)

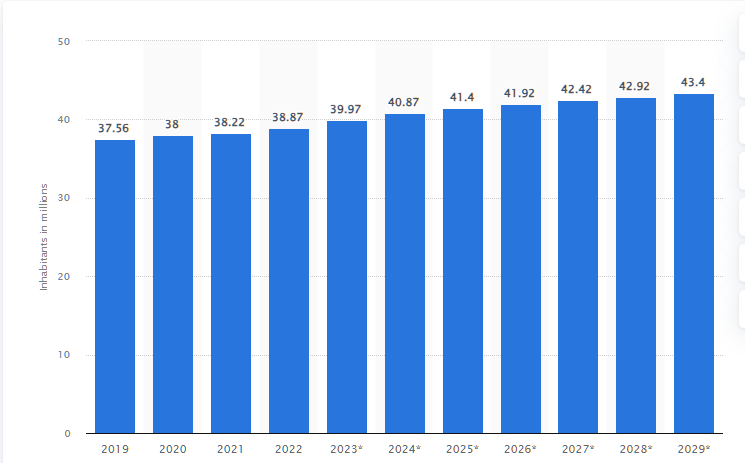

Canada's population grew faster than a teenager's appetite in the past year. With over 400,000 newcomers arriving in 2023 alone, the housing market had to brace itself for the influx. While welcoming new faces is great for the economy, it also strains the already tight housing supply.

Why does this matter? Because most newcomers rent before they buy, adding pressure to the rental market. Vacancy rates are dropping like the latest TikTok trend, and rents are shooting up faster than you can say 'affordable housing.' Rental rates have jumped by 8.6% in March 2024, compared to their level one year prior

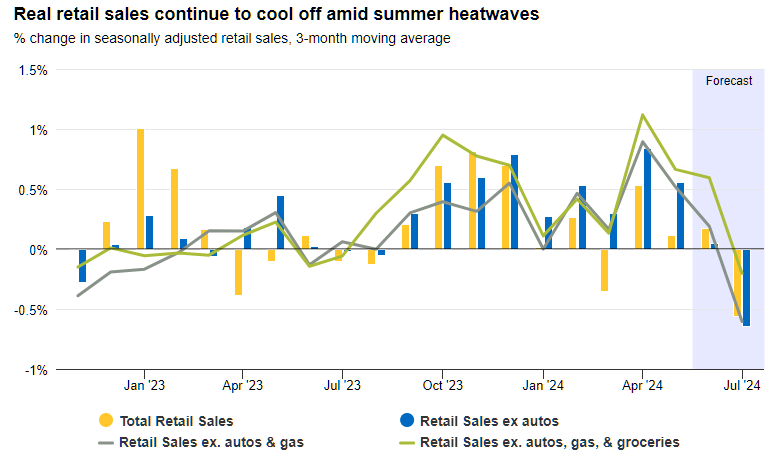

Consumer Spending: The Wallet Tightens

Canadian consumers are known for their love of maple syrup, hockey, and, of course, homes. But with inflationary pressures and high interest rates, spending patterns have taken a hit. After a brief post-pandemic spending spree, wallets are tighter than a toddler's grip on their favourite toy.

What's happening? High prices and interest rates have made financing homes more challenging, reducing disposable income for other expenditures. In essence, people are spending less on everything else to keep a roof over their heads and food on the table.

Experts Opinions: Economists Weigh In

CMHC's Chief Economist, Bob Dugan, has been busy analyzing the situation. According to Dugan, the economic outlook for 2024 points to weak growth, with a glimmer of hope on the horizon.

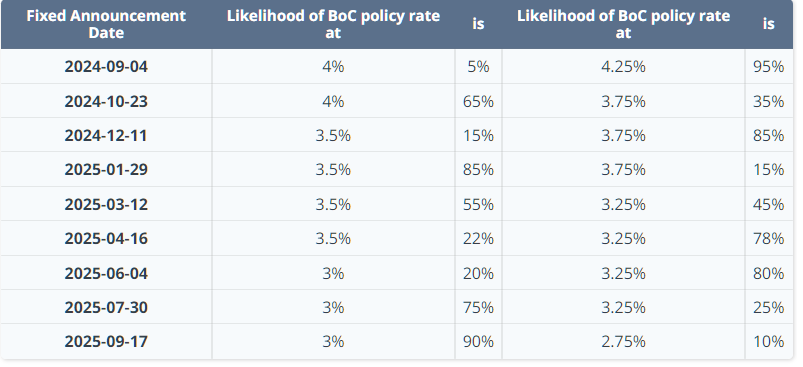

Dugan believes these interest rate cuts will stimulate a rebound in housing demand. As mortgage rates decrease, more buyers will jump back into the market, pushing sales and prices up.

Analysts suggest the Bank is now shifting its focus away from inflation and toward maintaining economic growth and avoiding a recession.

But don't pop the champagne just yet—this recovery will be gradual, not an overnight miracle.

Interest Rate the Ups & Downs

Interest rates have been the talk of the town, and for good reason. Initially kept high to combat inflation, the Bank of Canada has FINALLY hit the 'down' button twice this year and is eyeing another rate cut in September, thanks to some news down south in the US. This could be a glimmer of hope for the market.

What's the Impact?

Lower interest rates can feel like a breath of fresh air for those looking to buy a home or with renewals coming up. Reduced mortgage costs? Yes, please! Imagine buyers flocking back to the market like kids to a candy store.

But hold on a second. Let's get back to reality. Canadians are pretty leveraged right now. Their wallets are tighter than ever, so a slight dip in mortgage rates might seem like a tiny drop in the ocean. And we can't ignore the elephant in the room—many Canadians have hefty debts. This could slow down the rise in housing prices or even push them down a bit more before they climb back up.

Increased demand is likely to push prices up eventually. So, while some relief is on the horizon, it might take some time before we see housing prices start to rise again. Hang tight!

Increased demand is likely to push prices up eventually. So, while some relief is on the horizon, it might take some time before we see housing prices start to rise again. Hang tight!

Charts and Graphs: Because Numbers Don't Lie

Let's break up the text-heavy discussion with some eye-catching visuals:

Immigration and Population Growth:

Immigration and Population Growth:

-

Consumer Spending Trends:

-

Sharp decline in discretionary spending through July 2024 -

Bank Of Canada Interest Rate Forecast:

-

Two cuts already in 2024, another expected in September

Two cuts already in 2024, another expected in September

Navigating the housing market can be tricky, but there's a silver lining. Challenges are real, but so are the opportunities. Exercising patience may have proven beneficial for the individuals who waited to purchase their first home during these wild years we have experienced.

For personalized guidance on mortgage options, reach out to us at New Life Mortgages.ca. We're dedicated to assisting you in navigating the dynamic market and finding a place to call home amidst the chaos. Whether you're a first-time homebuyer, an experienced investor, looking to consolidate debt through refinancing, or simply aiming to stay informed about market trends, count on us to have your back.

Stay tuned for more updates, and remember—buy low, sell high, and always read the fine print.