Mortgage Blog

Start Your New Life In Your New Home

The Uncomfortable Truth About The Canadian Mortgage Market

March 13, 2024 | Posted by: Dallas Martin

In the grand theatre of the Canadian mortgage industry, 2024 has rolled out the red carpet for a few uninvited guests: soaring mortgage arrears, skyrocketing rent prices, and the ever-looming spectre of interest rate fluctuations. It's like we're all part of some high-stakes financial drama but without the popcorn.

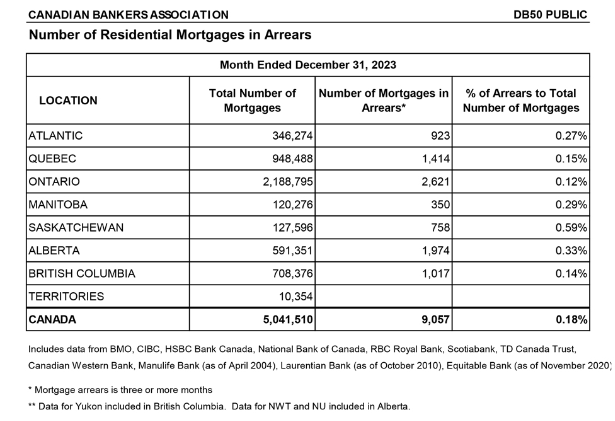

The Triple Threat: Mortgage Arrears on the Rise

Let's start with a scene that's been getting a lot of screen time lately: the surge in mortgage arrears. According to Canadian Mortgage Trends, Equitable Bank has seen its mortgage arrears rate triple amid a flurry of renewals. Now, if that doesn't make you want to grab a lifebuoy, I don't know what will.

However, let's not forget that Canada, the land of the polite and home of the resilient, still boasts some of the lowest mortgage arrears rates in the world. That's right; despite the recent uptick, we're doing alright on the global stage. We're sitting pretty compared to many of our international friends. While we're here fretting over our triple somersault increase, other countries are performing full-blown Cirque du Soleil routines with their mortgage arrears rates.

So, while it's easy to get caught up in the doom and gloom of rising arrears, especially reading the news, remember that in the grand scheme of things, Canada's still paddling steadily along. But It's a stark reminder that the house doesn't always win in the game of mortgages.

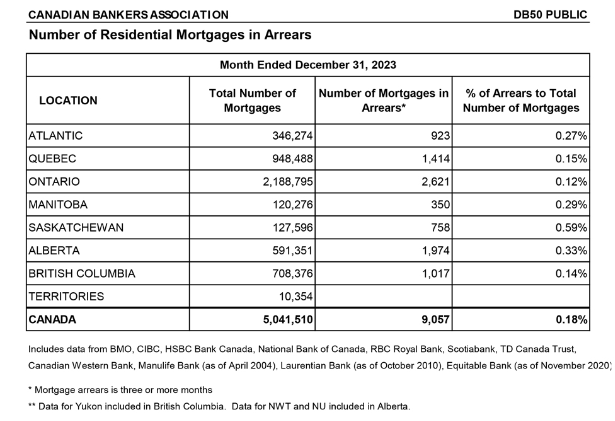

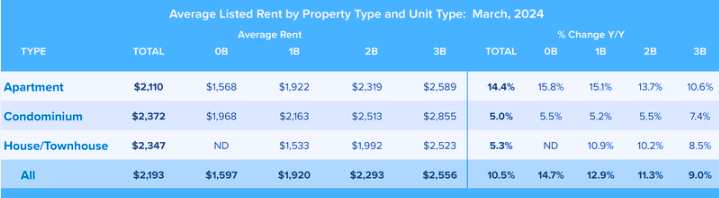

Rent Prices: The Sky's the Limit

Scene two takes us to the rental market, where the plot thickens. Rent prices hit an average of $2,193 in February, a staggering 10.5% climb from the previous year. For renters, this is akin to climbing a financial Mount Everest without oxygen.

And for investors? Many investors with mortgage rentals, whose mortgage rates have decided to mimic a rocket heading to Mars, don't have a buffet of choices. They're kind of stuck between a rock and a hard place. Their once cozy mortgage payments have now decided to hit the gym and bulk up, leaving these investors with little choice but to raise rents to offset their beefier mortgage payments.

So, while renters are feeling the pinch, it's crucial to remember that this isn't some grand conspiracy to make life harder. It results from a financial ecosystem as unpredictable as deciding to wear white on a day when you're also starting to crave spaghetti for lunch.

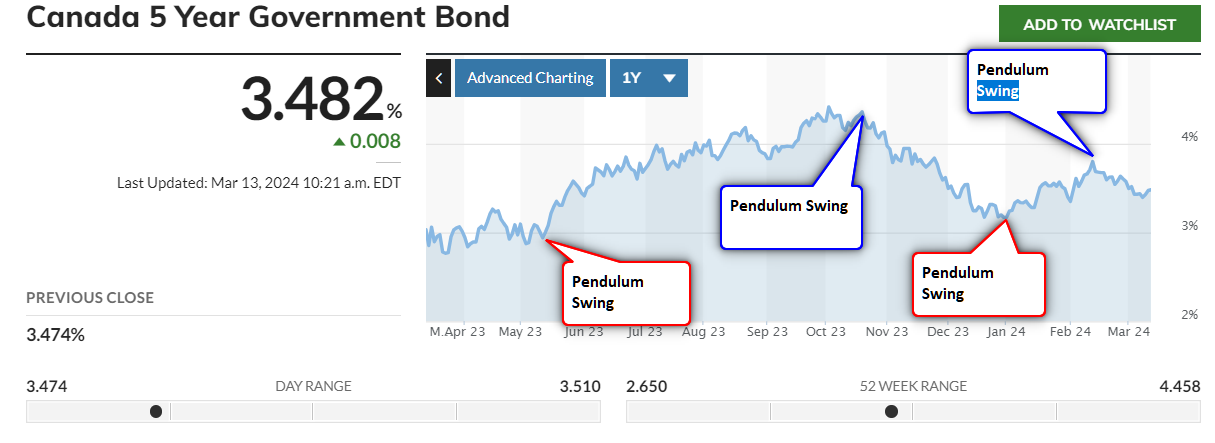

Interest Rates: The Pendulum Swings

Our final act delves into the murky waters of interest rates. With whispers of potential rate cuts by the top economists, everyone's on the edge of their seats. Lower rates might sound like the cavalry coming over the hill for current mortgage holders, but let's not start the victory parade just yet. A significant rate drop could reignite demand, pushing prices up and making affordability an even bigger villain in this narrative.

These developments spell out a cautionary tale for buyers. The dream of homeownership is becoming a maze of higher costs and tighter lending standards. Sellers, meanwhile, might find themselves in a conundrum where rising values meet a dwindling pool of buyers able to afford those prices.

Charting a Path Forward

In the end, navigating Canada's mortgage landscape requires a blend of courage, wisdom, and a dash of foresight. Whether you're looking to buy, sell, or simply survive, the key is staying informed and seeking guidance when the waters get choppy. Knowledge is your power-up in this game, and sometimes, you might need to call in a wizard (aka your trusted mortgage agent, Dallas Martin) when the going gets tough.

Remember, every challenge presents an opportunity—it's just a matter of finding the right compass to guide you through.

So, strap in, folks. 2024 will be one heck of a ride through the Canadian mortgage market. Stay savvy, stay informed, and most importantly, don't lose sight of the shore.

So, strap in, folks. 2024 will be one heck of a ride through the Canadian mortgage market. Stay savvy, stay informed, and most importantly, don't lose sight of the shore.